The Current Uniform CPA Examination is Changing Significantly in 2024!

11/14/2022|

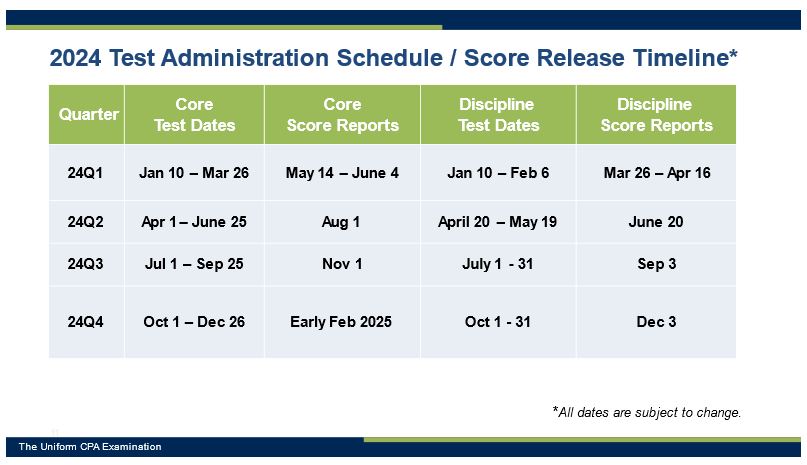

CPA Evolution is just around the corner. Have you heard of the CPA Evolution initiative? Are you aware that the Uniform CPA Examination® (CPA Exam) is changing significantly in January 2024? It is important that you learn about this initiative and the upcoming changes to the CPA Exam to fully understand how it might impact your journey to CPA licensure. If you pass and retain credit for all four CPA Exam sections by December 31, 2023, the changes to the CPA Exam and its future administration will NOT impact your journey. If you will still be working your way through the CPA Exam in January 2024 and beyond, then the information about the CPA Evolution-aligned CPA Exam (the 2024 Exam) and its administration are most important to understand. As we get closer to 2024, new information is being made available to help candidates plan their testing schedules in 2023 and into 2024. The National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA) are now releasing tentative application information and testing schedules for late 2023 and tentative testing and score release schedules for 2024. It is important to note that these dates are not yet final but are being provided as early as possible to help candidates consider their testing plans. Important 2023 Administration Dates First, candidates should note that the last day of testing for all current CPA Exam sections (AUD, BEC, FAR and REG) is anticipated to be December 15, 2023. No CPA Exam sections may be scheduled from December 16, 2023, through January 9, 2024, to allow for conversion of IT systems to the 2024 CPA Exam sections. Candidates are encouraged to plan their testing schedules accordingly. In addition, candidates wishing to take BEC in the latter part of 2023 need to know that the NASBA Gateway system will stop processing Authorizations to Test and Notices to Schedule for BEC on November 15, 2023. This will necessitate that Boards of Accountancy require final application deadlines (first-time and reexam) for BEC sections. These deadlines are yet to be determined and will be published on NASBA’s website once they become available, and shared by each Board of Accountancy. Conversely, Boards of Accountancy will also need to establish initial application acceptance dates for discipline sections: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). Authorizations to Test and Notices to Schedule for BAR, ISC and TCP will not be processed by NASBA’s Gateway system until November 22, 2023. These initial acceptance dates are also yet to be determined and will be published on NASBA’s website once they become available, and shared by each Board of Accountancy. AUD, FAR and REG applications can be continually submitted and processed as the same codes will be used for the core sections that will start in 2024, however the scheduling blackouts do apply. Important 2024 Administration Dates AICPA has published the tentative 2024 CPA Exam testing schedule and score release schedule. Please note that these dates are tentative pending further review by AICPA.  It is anticipated that testing will commence on January 10, 2024, for all sections. While the core sections (AUD, FAR and REG) will first be available for scheduling through March 26, 2024, in the first quarter of 2024, the discipline sections (BAR, ISC and TCP) will be available through February 6, 2024. Scores are anticipated to only be released once per test section per quarter due to necessary standard-setting analyses and activities. Boards of Accountancy Considering Credit Extension and Other Relief Due to the limited testing schedule and delayed score releases in 2024, the CBT Administration and Executive Directors Committees of NASBA have recommended a policy to Boards of Accountancy for consideration, which would allow candidates with Uniform CPA Examination credit(s) on January 1, 2024, to have such credit(s) extended to June 30, 2025. Each Board of Accountancy must individually consider if it wishes to adopt such a policy. NASBA has published a map on its website, which will be updated as boards consider the policy. To date, 39 jurisdictions have already approved the policy. Others will be reviewing it at upcoming board meetings. In some states, the board may be favorably inclined to adopt the policy, but legislative rule making may be required, which could take some time. Boards of Accountancy will also be asked to consider a rule change that is currently under exposure for comment. It is anticipated that the model rule under the Uniform Accountancy Act, could be available in final form by early 2023. Such a rule, if adopted by a Board of Accountancy, would shift the start date of the 18-month credit period to the date a passing score was released by NASBA to the candidate or a board. Currently, many boards utilize earlier dates such as the date a candidate tests. If adopted, this could provide additional relief to candidates. Each board must decide whether or not to change their rules. This will be a longer-term initiative, as rule changes can take some time, depending on the jurisdiction. NASBA will develop and publish a map showing jurisdictional rules on this topic in the near future. Transition Policy Reminder The new CPA licensure and CPA Exam model is a Core and Discipline model. In February 2022, a transition policy was announced. This policy lays out how CPA Exam sections passed under the current CPA Exam map to credit under the 2024 CPA Exam. Candidates who will start taking the CPA Exam in 2023 but continue to take sections in 2024 should review this policy and the FAQs on NASBA’s website. ********* It’s never been a more exciting time to pursue the CPA license. The role of today’s CPA has evolved, and newly licensed CPAs are taking on increased responsibilities that were traditionally assigned to more experienced staff. Becoming a CPA means you’ll need great skill sets and competencies, and a greater knowledge of emerging technologies. That is why the CPA Evolution initiative is underway. As additional information becomes available pertaining to CPA Evolution and the 2024 CPA Exam, we will continue to share it with you. FAQS are available that might answer some of your more detailed questions regarding the information provided above, as well as the transition policy released in February 2022. Additional information and FAQs regarding the CPA Evolution initiative are available at EvolutionofCPA.org. If your questions on the new CPA licensure model and CPA Exam are still not answered, please reach out to us at Feedback@EvolutionofCPA.org. For information on becoming a CPA, please visit This Way to CPA. This communication to CPA Exam candidates has been shared with Boards of Accountancy, State CPA Societies, accounting academia, CPA Exam review course providers and other accounting organizations. |